Bridges@Work is a workplace-based program that helps employees navigate the non-work challenges that can make it harder to get to work, stay focused at work, and keep a job.

In partnership with Catholic Charities, the program provides an on-site Resource Coordinator who offers confidential, one-on-one support. This might include a zero-interest loan to cover a car repair, resources for elder care, or a referral to mental health services.

By helping individuals address these social determinants of work—the non-employment-related barriers that impact job retention and advancement—Bridges@Work is part of our broader mission of creating pathways to economic mobility and long-term stability.

Breaking the cycle of high-interest debt

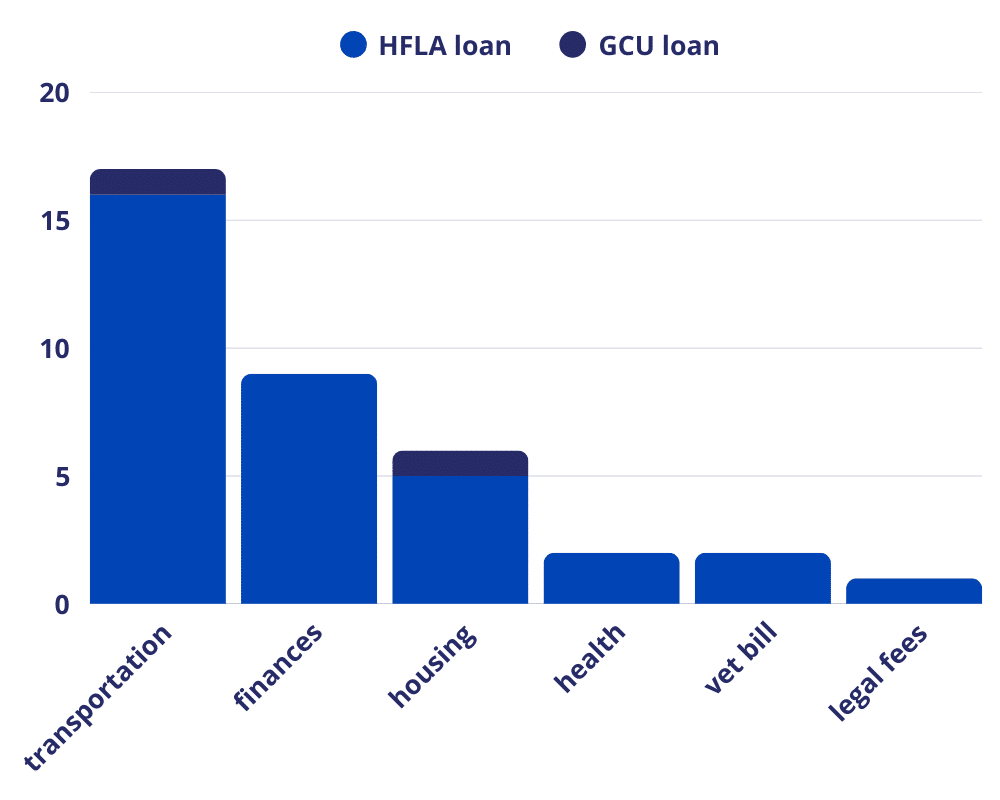

A unique feature of the Bridges@Work program is that it gives participants access to zero-interest, small-dollar loans through the Hebrew Free Loan Association (HFLA). These loans help employees address unexpected expenses such as car or home repairs, household expenses, or medical bills.

Zero-interest loans paired with financial counseling around repayment help employees build credit and avoid getting trapped in high-interest debt. Using credit cards, payday loans, or other high-interest mechanisms to pay for unexpected costs can spiral someone’s finances into mounting debts that become increasingly difficult to pay off.

The onsite Resource Coordinator helps the employee apply for the loan and follows up to help them navigate loan logistics and budget for repayment. For employees with larger expenses, the Resource Coordinator can help them navigate getting a traditional personal loan with Geauga Credit Union (GCU).

When your car breaks down, your job is at risk

For Geauga County workers, driving is often the only way to get to work. In addition to limited public transportation options within Geauga County, more than 80% of recent Bridges@Work participants live in a different county. This makes reliable personal transportation a requirement for staying employed.

Owning a car is expensive, and repair costs can vary dramatically from month to month. According to AAA, vehicle maintenance averages about $0.10 per mile. In Ohio, the average person drives 14,278 miles per year, which translates to around $1,400 in annual maintenance.

But it’s not uncommon for vehicle owners to face an unexpectedly large repair bill. Maybe the transmission fails, or a deer runs into their car. For employees already struggling to cover monthly bills, such costs could force them to turn to high-interest debt. Not repairing the car isn’t an option—without it, they would have no way to get to work.

In these situations, access to budgeting tools and small, zero-interest loans can help employees maintain transportation to work without falling into high-interest debt.

Stability builds a stronger workforce

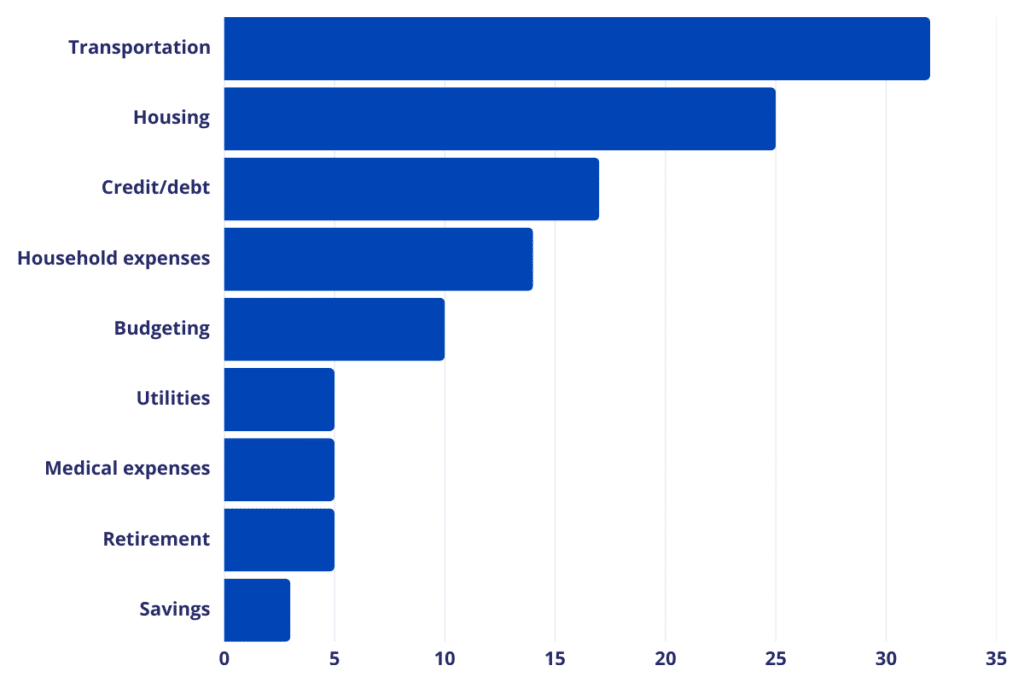

In addition to transportation, many of the other issues addressed through Bridges@Work are related to financial stress. Some people are struggling with rent payments or household expenses. Others need financial coaching to manage debt, set a budget, or build savings.

Providing people with tools for financial planning and access to zero-interest loans helps move program participants toward financial stability: consistent income, a consistent budget, and manageable debt. Having financial stability makes it easier for people to show up and stay focused at work.

Helping employees manage their finances also benefits employers. People with fewer financial distractions are more likely to be dependable, productive, and stay in their jobs. That’s especially important in fields where hiring and training are costly or time-consuming.

To help address this core need for financial tools and coaching, Bridges@Work offers optional classes taught by Apprisen. These classes help employees increase their financial literacy and knowledge of financial planning tools, supplementing the one-on-one assistance offered by the Resource Coordinator.

Why confidentiality is everything

Talking about finances and personal issues is vulnerable, and employees often fear that telling their supervisor or HR team about a challenge they are facing may have repercussions for their job.

What makes the Bridges@Work model effective is the presence of a trusted, confidential support person inside the workplace. Employees know they can speak to their Resource Coordinator without that information going to their boss or HR.

The first session with the Resource Coordinator is often general, providing the employee with information about the program and answering questions. As the employee grows to trust the Resource Coordinator, they feel more comfortable sharing details and can receive more personalized support.

It’s not surprising, then, that over half of the clients seen by the Resource Coordinator during the past year had multiple contacts. Follow-ups are a core piece of the program’s model and help employees receive the biggest benefit from its resources. Especially with loans, having follow-up support and help creating a payback plan reduces recidivism and supports financial success.

“Building a trusting relationship between the Resource Coordinator and the employee is a key ingredient to the success of the program. Participants know that they can trust Missy to discuss highly sensitive topics and protect their anonymity from their employer and co-workers,” says Mark Dorony, Bridges@Work Program Manager.

It's not just about money

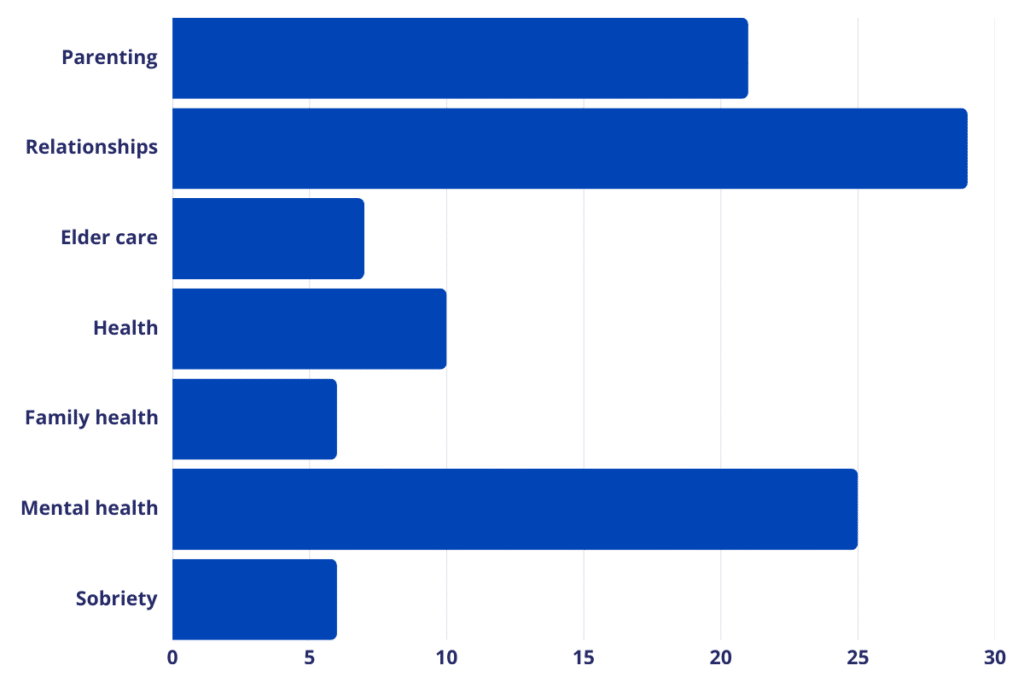

There is a wide range of factors that can affect people’s productivity and ability to show up to work. In addition to financial resources, the Resource Coordinator can help with stressors like mental health struggles, navigating elder care, or managing difficult family relationships.

There is a counseling-focused aspect to the Resource Coordinator role that can benefit people in situations where resolution is long-term and stress is ongoing, particularly in the areas of caregiving, relationships, and health.

These areas can significantly impact someone’s ability to focus at work and can increase absenteeism and poor performance. Having a trusted, in-house support helps employees navigate these common challenges.

Caregiving is a big source of stress and absenteeism, and it is a growing challenge for employers as the American population ages and more workers are caring for another adult. A 2023 survey by S&P Global and the AARP found that 67% of adult caregivers said they had “at least some difficulty in balancing work and life responsibilities.” Significant numbers took a leave of absence (31.8%), reduced work hours (26.9%), or turned down a promotion (16.2%).

Mental health is also a pervasive factor affecting the American workforce. According to the Life Insurance Marketing and Research Association, 75% of U.S. workers say they’ve faced at least one mental health challenge in the past year, and 37% say they struggle often.

The stress of mental health struggles and caregiving can affect worker engagement, ability to effectively collaborate with colleagues, and rates of absenteeism, negatively impacting both an employee’s career growth and the employer’s success.

While the Resource Coordinator model is not a replacement for specialized mental health treatment or caregiving support programs, it is a unique, in-house support model that provides a baseline of empathetic counseling alongside practical referrals to the best-fit local programs for each individual.

Building a foundation for long-term success

Bridges@Work demonstrates what’s possible when we meet people where they are, literally and figuratively. By embedding a compassionate, confidential resource into the workplace and addressing the social determinants of work, we help individuals retain employment, build resilience, and thrive in the face of adversity.

The result is a stronger workforce, one where people feel supported, employers see better retention, and everyone has a fairer shot at building a more secure future.

This article was drafted with the assistance of generative AI and edited and fact-checked by the author.